Spring into Action: Boost Your Home’s Curb Appeal with Expert Guidance

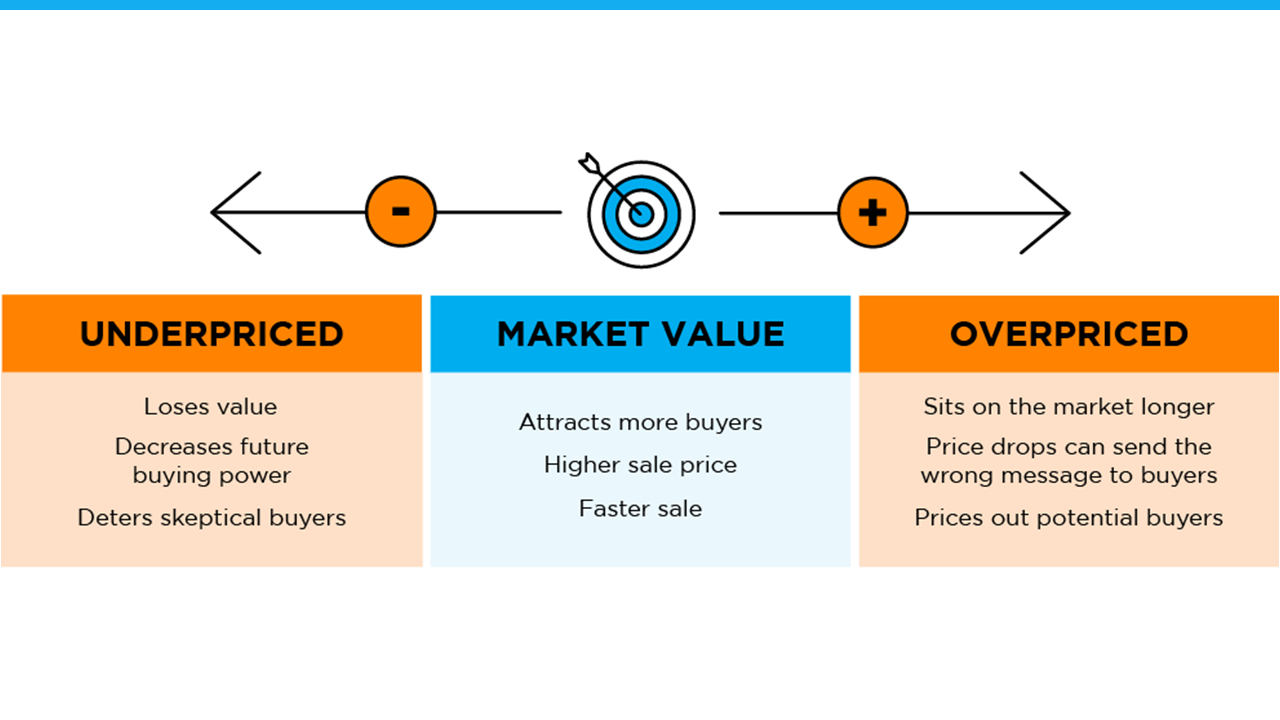

To sell your home this spring, it may need more preparation than it would have a year or two ago. Today’s housing market has a different feel. There are more homes for sale than there were at this time last year, but inventory is still historically low. So, if a house has been sitting on the market for a while, that’s a sign it may not be hitting the mark for potential buyers. But here’s the thing. Right now, homes that are updated and priced at market value are still selling fast.

Today, homes with curb appeal that are presented well are still selling quickly, and sometimes over asking price. According to Danielle Hale, Chief Economist at realtor.com:

“In a market where costs are still high and buyers can be a little choosier, it makes sense they’re going to really zero in on the homes that are the most appealing.”

With the spring buying season just around the corner, now’s the time to start getting your house ready to sell. And the best way to determine where to spend your time and money is to work with a trusted real estate agent who can help you understand which improvements are most valuable in your local market.

Curb Appeal Wins

One way to prioritize updates that could bring a good return on your investment is to find smaller projects you can do yourself. Little updates that boost your curb appeal usually work well. Investopedia puts it this way:

“Curb-appeal projects make the property look good as soon as prospective buyers arrive. While these projects may not add a considerable amount of monetary value, they will help your home sell faster—and you can do a lot of the work yourself to save money and time.”

Small cosmetic updates, like refreshing some paint and power washing the exterior of your home, create a great first impression for buyers and help it stand out. Work with a real estate professional to find the low-cost projects you can tackle around your house that will appeal to buyers in your area.

Not All Updates Are Created Equal

When deciding what you need to do to your house before selling it, remember you’re making these repairs and updates for someone else. Prioritize projects that will help you sell faster or for more money over things that appeal to you as a homeowner.

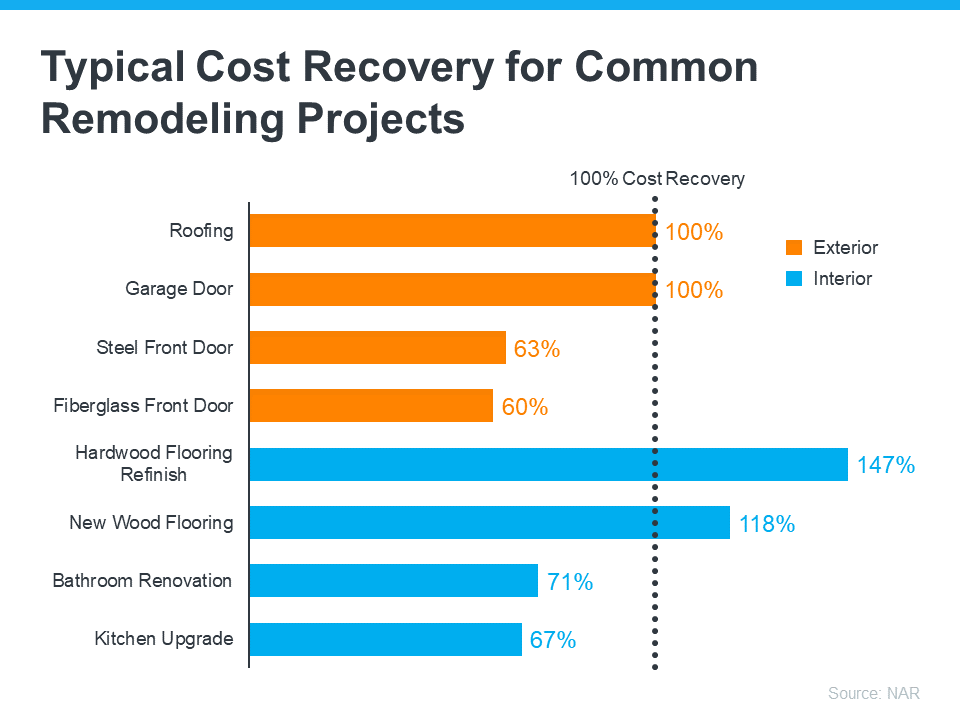

The 2022 Remodeling Impact Report from the National Association of Realtors (NAR) highlights popular home improvements and what sort of return they bring for the investment (see graph below):

Remember to lean on your trusted real estate advisor for the best advice on the updates you should invest in. They’ll know what local buyers are looking for and have the latest insights of what your house needs to sell quickly this spring.

Bottom Line

As we approach the spring season, now’s the time to get your house ready to sell. Let’s connect today so you can find out which updates make the most sense.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

![What’s Really Happening with Home Prices? [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2023/01/19134245/Whats-Really-Happening-With-Home-Prices-MEM-1046x2447.png)